EPF Account 3 to Commence in May, Allowing Members to Withdraw Anytime

The Employees’ Provident Fund (EPF) is on the verge of disclosing details about Account 3, a novel flexible account empowering members to withdraw funds at their discretion.

Preceding the official announcement, early details regarding Account 3 have surfaced, with contributions anticipated to kick off as soon as May.

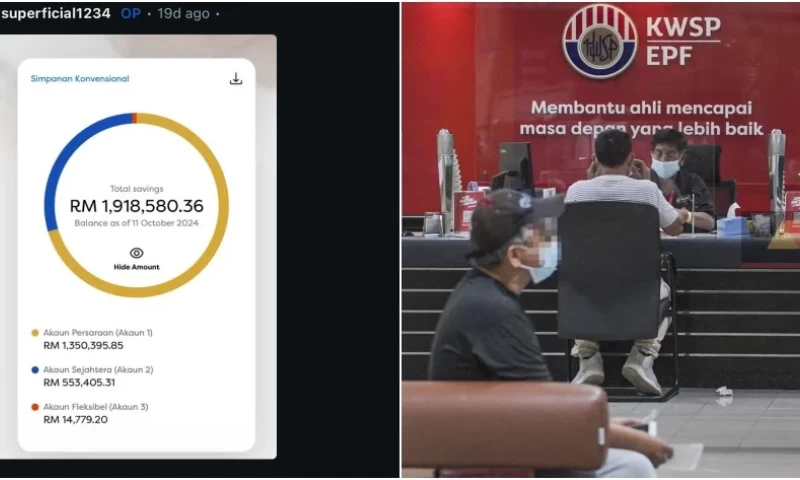

As per reports, Account 3 will initiate with a zero balance and encompass 10 percent of forthcoming monthly contributions. Under the revamped system, Account 1 will absorb 75 percent of the monthly contribution, while Account 2 will receive 15 percent. Currently, monthly EPF contributions are divided with 70 percent allocated to Account 1 and 30 percent to Account 2.

In contrast to Account 1 and Account 2, where withdrawals are confined to retirement or specific purposes such as education, healthcare, housing, and partial withdrawals at age 50, Account 3 offers members the flexibility to withdraw funds at their convenience, resembling a savings account. Finance Minister II Amir Hamzah has indicated that this new account will supersede the implementation of EPF-targeted withdrawals.

According to sources, funds held in Account 3 may receive a nominal payment, expected to be lower than the dividends for Account 1 and Account 2. Nonetheless, EPF members will reportedly have the opportunity to optimize capital gains by transferring funds from Account 3 to Accounts 1 and 2.

Recently, EPF declared a dividend of 5.5 percent for members with conventional accounts and 5.4 percent for Syariah accounts for 2023. In total, EPF disbursed RM57.81 billion to members for 2023. As of the end of 2023, there were 8.5 million active EPF members.